I’ve read a number of forecasts for year 2009 regarding travel industry. Various experts have tried to analyze what’s going to happen next year and what will be the main trends. The credit crunch and economic downturn play a major part in every report – of course – but there are many theories about the consequences of the downturn. Do the tough times require faster progress in technology? Are the big players just going to cut back all R&D costs and settle for what’s been working before? Who are the winners: agile, innovative newcomers with small cash buffers or the established GDS giants?

I’ll summarize the main points from the forecast reports. The points reflect the travel industry perspective.

Consolidation. Year 2009 will see more mergers and acquisitions in the travel industry. Consolidation will occur in both established companies merging horizontally and the big boys shopping for Travel 2.0 startups. We’ve already seen airline mergers (e.g. Alitalia case) and there’s more to come (BA and Iberia?; Lufthansa and Austrian?; etc.). It’s not only airlines merging but also smaller OTAs who haven’t really found their competitive niche as independent businesses. Some startups, on the other hand, face difficulties in raising more venture capital and we’ll see more tradesales in the TripAdvisor / Expedia style. Good for us, TripSay.com is doing well in terms of financial runway.

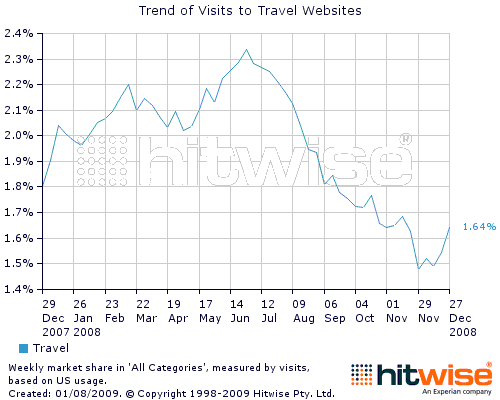

Marketing. Online marketing will grow along with the overall transition from high street physical stores to the online world (at least in Europe). The transition is happening because of the need to be more efficient and cut costs. However, the activities done online will change: there won’t be many experiments – “hey, let’s try this social media” brand campaigns – but less experimentation and more measuring. There’s huge potential in driving the conversion rates up and analysing web site visitors and understanding the online purchasing process. As more business is done online, the marketplace becomes crowded and some costs, e.g. CPC, will raise. Thus conversion rates become critical in order to keep CPA as good as possible.

Price-consciousness. Holiday travelers will become more price-conscious. If people previously looked for the best price on three sites, they’ll check six sites now. Differentiating and clever use of user generated content (UGC) will pay back. People will seek quality at a good price and want to avoid surprise costs – this offers a good chance for all-inclusive holiday travel packets. People are also looking for viable alternative destinations instead of the traditional favorites. E.g. in Europe you’d fly to the Mediterranian instead of South-East Asia to get some sun and beach life.

Technology. The search for better conversion rates and differentiation requires utilizing new technology in product packaging, UGC, personalization and communication channels. Transportation (i.e. flights) and accommodation (i.e. hotels) have become a commodity. Branded, dynamic real-time packaging will be a way for travel agents to differentiate and offer unique service. Personalization will be critical in order to drive up the conversion rates. Look to book ratio will decrease, i.e. people will browse more sites and read more reviews before making the actual purchase. Imaginative use of UGC helps because people trust objective UGC more than advertising (78% vs 14% / Universal McCann)

The main sources for this summary have been Travolution’s article Predictions for 2009, VentureBeat’s Another negative prediction for online ad spending in 2009, EuroMonitor’s Global Trends 2008 Overview, and a number of other articles and discussions.

Happy New Year 2009!

Regards from the sunny Barcelona! The European early stage investment forum (

Regards from the sunny Barcelona! The European early stage investment forum (

In these digital times it sometimes helps to explain things in analog terms. How to tell about a web 2.0 start up to people who associate business on web with selling dog food at a loss to huge number of potential (vs. buying) customers? One solution: find an analogy from the “real” world. Here’s my case example:

In these digital times it sometimes helps to explain things in analog terms. How to tell about a web 2.0 start up to people who associate business on web with selling dog food at a loss to huge number of potential (vs. buying) customers? One solution: find an analogy from the “real” world. Here’s my case example: The “million dollar question”: What makes a good social media web site? Providing a useful service and putting in the standard social media concepts such as social graph, wisdom of crowds and UGC are the pre-requisites but hardly enough if the site doesn’t provoke people’s interest. The diminishing attention span of the Internet public calls for simplicity and differentiation. Oh, and the first time user’s

The “million dollar question”: What makes a good social media web site? Providing a useful service and putting in the standard social media concepts such as social graph, wisdom of crowds and UGC are the pre-requisites but hardly enough if the site doesn’t provoke people’s interest. The diminishing attention span of the Internet public calls for simplicity and differentiation. Oh, and the first time user’s  Social media is one of the Web 2.0 core concepts. As such, understanding the concept thoroughly is one of the keys in developing a successful Web 2.0 web site.

Social media is one of the Web 2.0 core concepts. As such, understanding the concept thoroughly is one of the keys in developing a successful Web 2.0 web site.